How to Trade Futures on Bybit

What are Spot, Spot Margin, and Futures Trading?

The cryptocurrency market provides numerous avenues for trading assets, and for beginners, it’s crucial to grasp the fundamentals of three common methods:

This article will simplify these three approaches in a beginner-friendly manner, aiding you in understanding the key distinctions and guiding you to identify the most suitable method for your needs.

Spot Trading

Spot trading is similar to buying and selling in the real world. When you engage in Spot trading, you’re directly buying or selling the actual asset, like Bitcoin or Ethereum, at its current market price. This involves a direct exchange of two (2) assets between buyer and seller, granting you immediate ownership of the assets. Here’s what you need to know:

- Immediate Exchange: You get the actual assets right away.

- Ownership: You possess the asset, and it can be stored in your wallet.

- No Leverage: You utilize your own assets to trade without employing leverage.

Spot Margin Trading

Spot Margin trading adds a variation to Spot trading by allowing you to borrow funds from the platform to make bigger trades. Here’s how it differs:- Leverage: You can buy or sell more assets by borrowing funds from the platform.

- Collateral: You will need to have other margin assets as collateral to secure your borrowing.

- Ownership: While you retain ownership of the asset, there’s a liquidation risk if things take a downturn, such as when your loan-to-value ratio becomes too high.

Futures Trading

Futures are contracts that derive their value from an underlying asset. When you buy or sell a Futures contract, you do not own the underlying crypto assets. Instead, you are entering into agreements to buy or sell assets at a predetermined price on a specific future date.In the cryptocurrency Futures market, you don’t necessarily need to buy or sell the underlying assets upon the delivery date. Instead, your profit or loss is based on the difference between the value of the assets when you entered the market and its value on the delivery date or the day you sell the contract.

Bybit offers various Futures contracts, including Inverse and USDC Futures contracts with expiration dates ranging from daily to quarterly. Additionally, Perpetual contracts such as Inverse, USDT, and USDC Perpetual contracts have no expiration date.

- Leverage: You can hold a larger position size with a smaller margin required. However, be cautious, as using lower margins to maintain your position increases the risk of liquidation.

- Expiration Date: For a Futures contract, there is an expiration date and you must settle it by closing the position when the contract expires. In contrast, Perpetual contracts have no expiration date and can be held indefinitely, as long as you meet the margin requirements. It’s important to note that there is still a potential for liquidation if margin requirements are not maintained.

- Speculation and Hedging: Used for both speculation (profit-seeking) and hedging (risk mitigation) purposes.

Comparison Between Spot, Spot Margin and Futures Trading on Bybit

|

Spot Trading |

Spot Margin Trading |

Futures Trading |

||

|

Futures Contracts |

Perpetual Contracts |

|||

|

Market |

Spot Market |

Spot Market |

Futures Market |

Perpetual Market |

|

Expiration Date |

N/A |

N/A |

The expiration date ranges from daily to quarterly. |

Have no expiration date, allowing you to hold them indefinitely. |

|

Trading Fee |

Spot Trading Fee |

1. Spot Trading Fee 2. Interest charged on borrowed amount 3. Repayment handling fee if auto repayment is triggered. |

1. Futures Trading Fee 2. Settlement Fee For the Unified Trading Account (UTA), interest and repayment handling fees may be incurred. |

1. Perpetual Trading Fee 2. Funding Fee For the Unified Trading Account (UTA), interest and repayment handling fees may be incurred. |

|

Leverage |

Leverage is not supported. To acquire assets worth 100 USDT,you need to possess 100 USDT in your account. |

Leverage enables you to use X times the funds you currently have to buy or sell. For instance, with 10x leverage and 10 USDT, you can purchase an asset worth up to 100 USDT. Deducting the 10 USDT you already have, you can borrow 90 USDT from the platform (excluding other factors). |

Leverage allows you to open a position using a smaller amount of capital. For example, for a position requiring 100 USDT as the initial margin, without leverage, you’d need 100 USDT to cover the cost. However, with 10x leverage, you’d only need 10 USDT to open a position worth 100 USDT. |

|

|

Maximum Leverage |

N/A |

10x |

Ranging from 25x to 125x, according to the trading pair. |

|

|

Borrowing |

Not Supported |

Users can borrow funds from the platform and calculate interest for the next hour. |

For Standard Account, borrowing is not supported. For the UTA, users can borrow funds for Futures trading. |

|

|

Collateral |

N/A |

Needs to have sufficient margin assets as the collateral for repayment to avoid being liquidated. |

Initial Margin (IM) is the collateral for the position. IM = Position Value / Leverage |

|

|

Source of Profit |

You benefit from capital appreciation as the value of your cryptocurrency rises over time. |

You can borrow from the platform to buy or sell an asset even if you do not own it, as long as you have sufficient margin assets as collateral. |

Enables you to capitalize on short-term price fluctuations in both directions. |

|

|

Liquidation Risk |

No |

Yes |

Yes |

Yes |

|

Liquidation Indicator |

N/A |

For Standard Account: Liquidation is triggered when the Loan-to-Value (LTV) ratio reaches 95%. For UTA: Liquidation occurs when the Maintenance Margin Ratio (MMR%) reaches 100%. |

For Standard Account: Liquidation occurs when the Mark Price reaches the Liquidation Price. For UTA: Liquidation occurs when the Maintenance Margin Ratio (MMR%) reaches 100%. |

|

|

What will happen when liquidation triggers? |

N/A |

The system will auto-repay all your borrowed amount and interest with your margin assets. |

Depending on your margin mode, you will lose partial (partial liquidation) or all the invested margin to maintain the position. |

|

How to Trade Perpetual Futures on Bybit (Web)

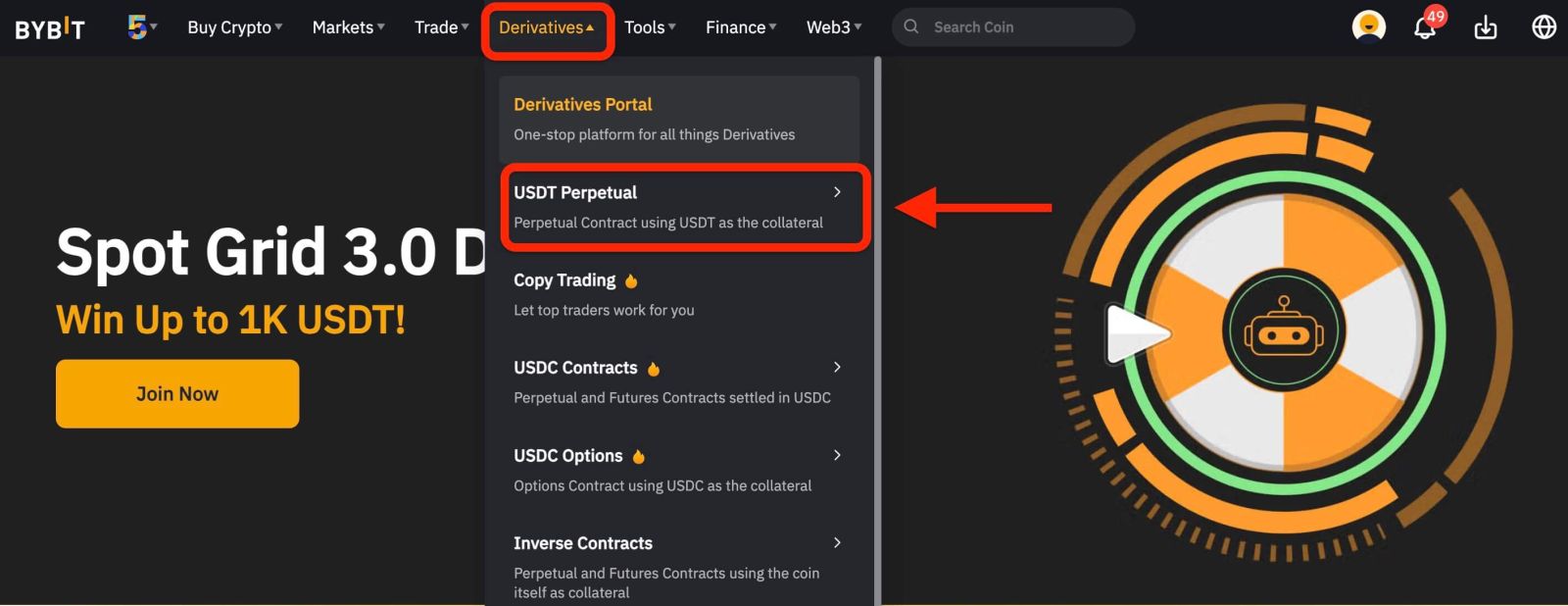

1. Log in to the Bybit website and navigate to the "Derivatives"--"USDT Perpetual" section by clicking the tab at the top of the page.

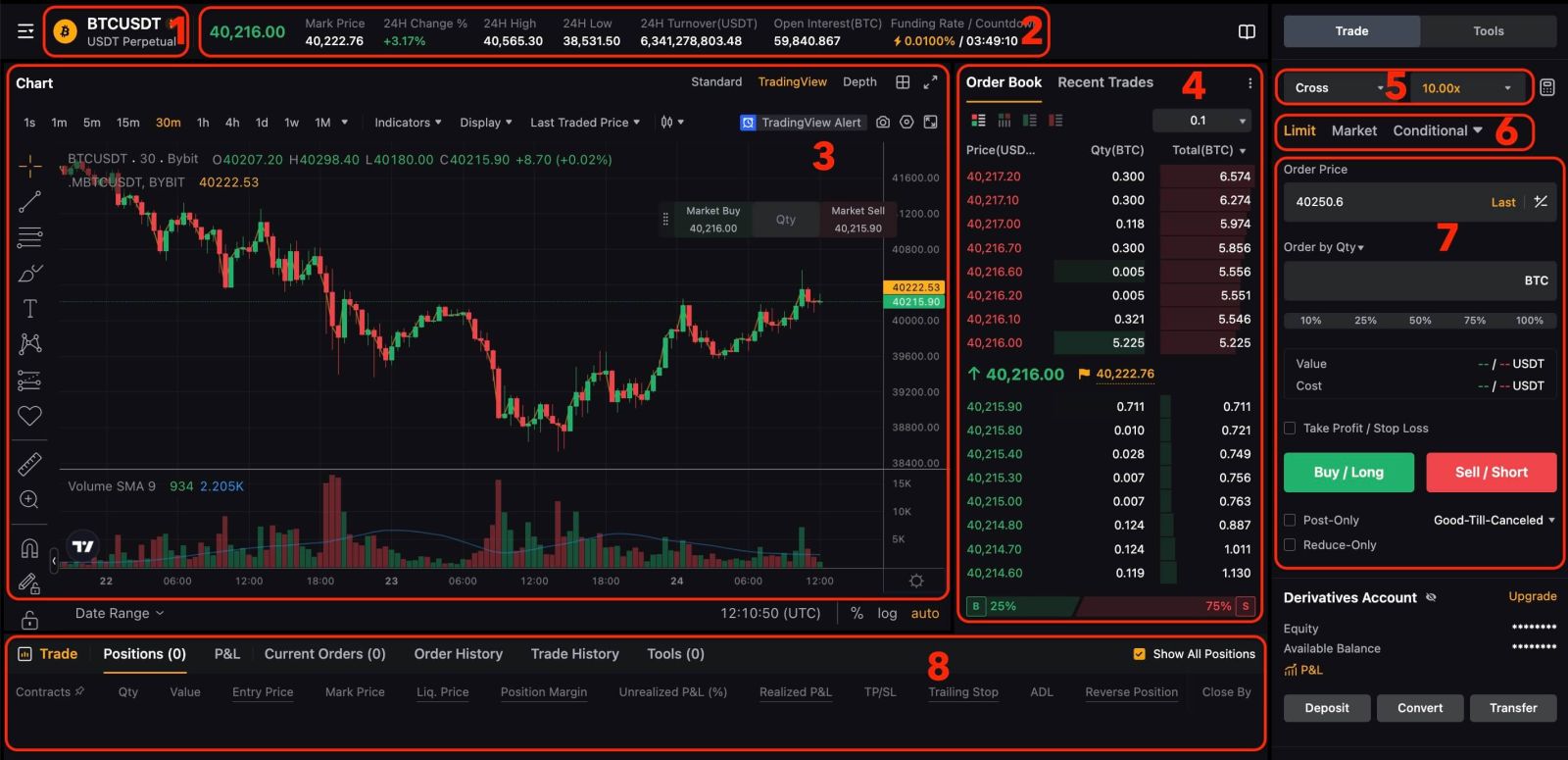

- Trading Pairs: Shows the current contract underlying cryptos. Users can click here to switch to other varieties.

- Trading Data and Funding Rate: Current price, highest price, lowest price, increase/decrease rate, and trading volume information within 24 hours. Display the current and next funding rate.

- TradingView Price Trend: K-line chart of the price change of the current trading pair. On the left side, users can click to select drawing tools and indicators for technical analysis.

- Orderbook and Transaction Data: Display the current order book and real-time transaction order information.

- Position and Leverage: Switching of position mode and leverage multiplier.

- Order type: Users can choose from a limit order, market order, and trigger order.

- Operation panel: Allow users to make fund transfers and place orders.

- Position and Order information: Current position, current orders, historical orders and transaction history.

2. On the left-hand side, select BTCUSDT from the list of futures.

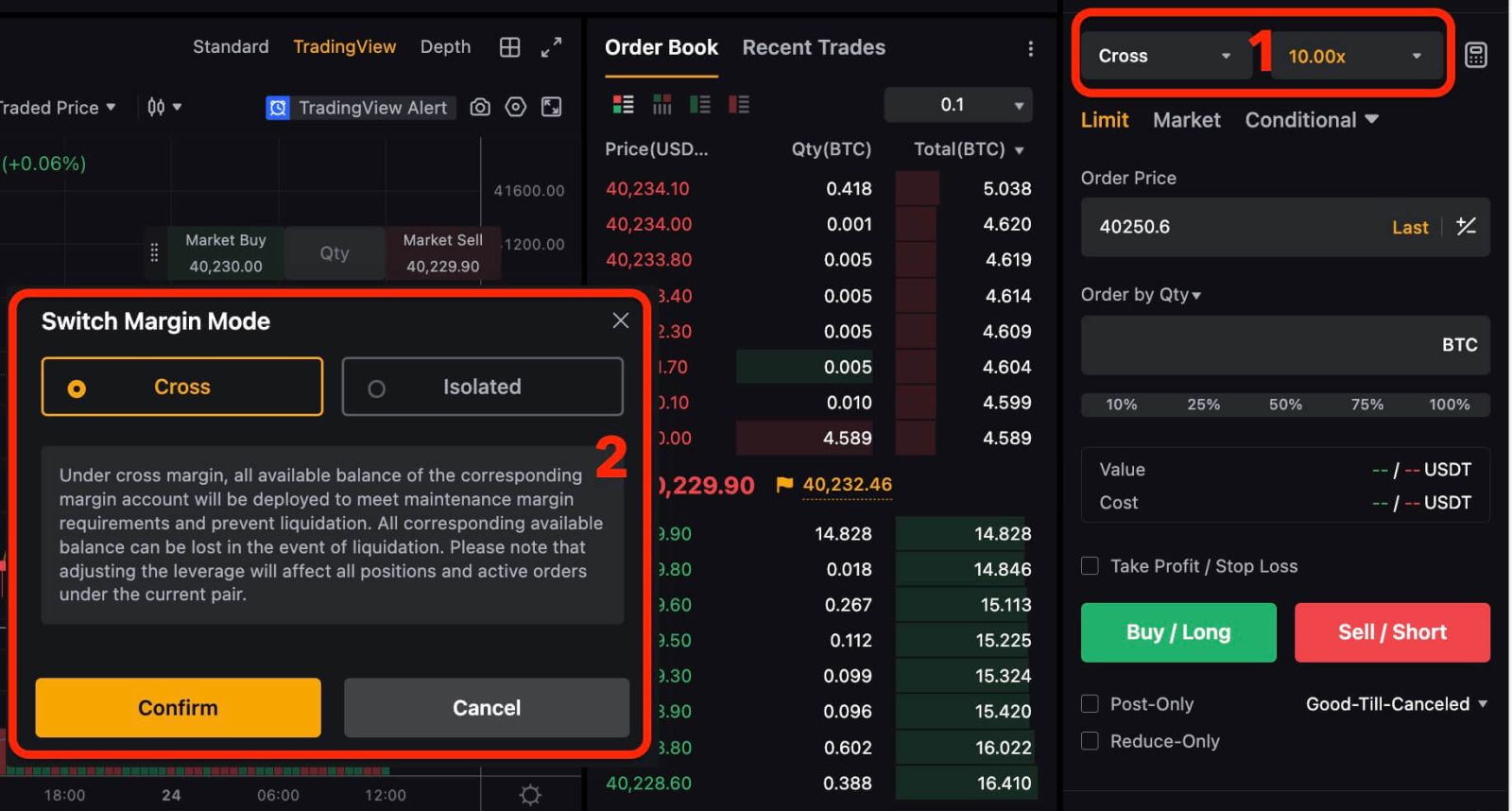

3. Choose "Position by Position" on the right to switch position modes. Adjust the leverage multiplier by clicking on the number. Different products support varying leverage multiples—please check the specific product details for more information.

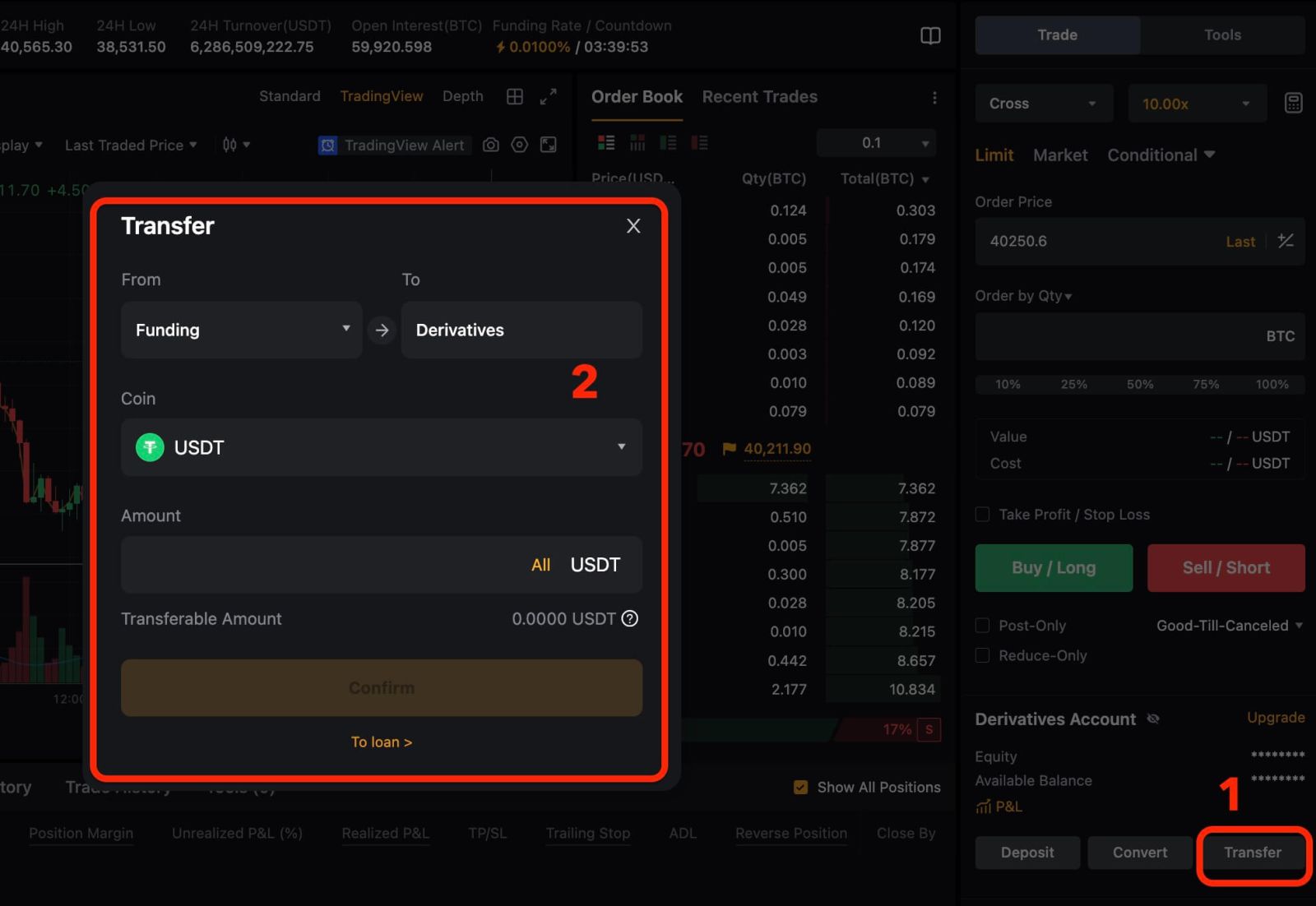

4. Click the Transfer button on the right to access the transfer menu. Enter the desired amount for transferring funds from the Funding to Derivatives and confirm.

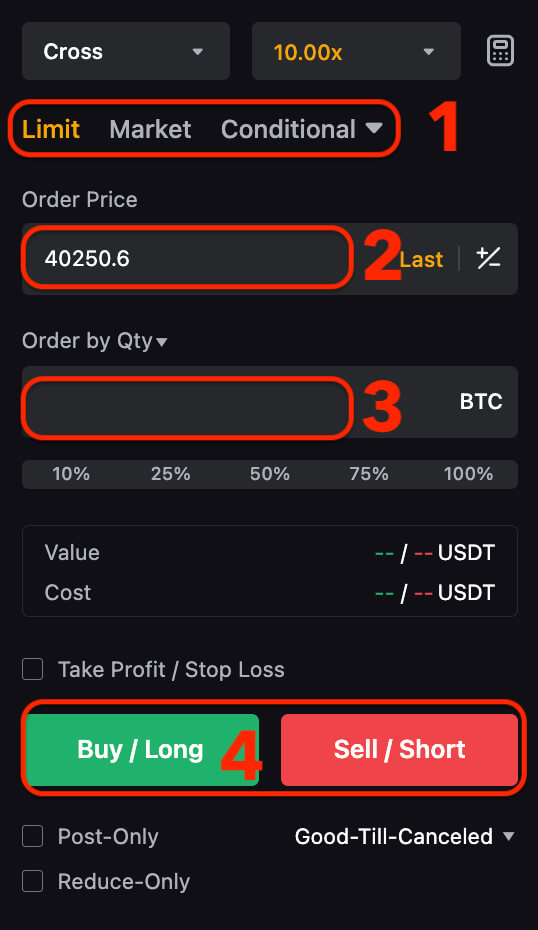

5. To open a position, users can choose between three options: Limit Order, Market Order, and Conditional Order. Enter the order price and quantity and click Open.

- Limit Order: Users set the buying or selling price by themselves. The order will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for the transaction in the order book;

- Market Order: Market order refers to the transaction without setting the buying price or selling price. The system will complete the transaction according to the latest market price when placing the order, and the user only needs to enter the amount of the order to be placed.

6. After placing your order, view it at the bottom of the page. You can cancel orders before they’re filled. Once filled, find them under "Position".

7. To close your position, click "Close".

How to Trade Perpetual Futures on Bybit (App)

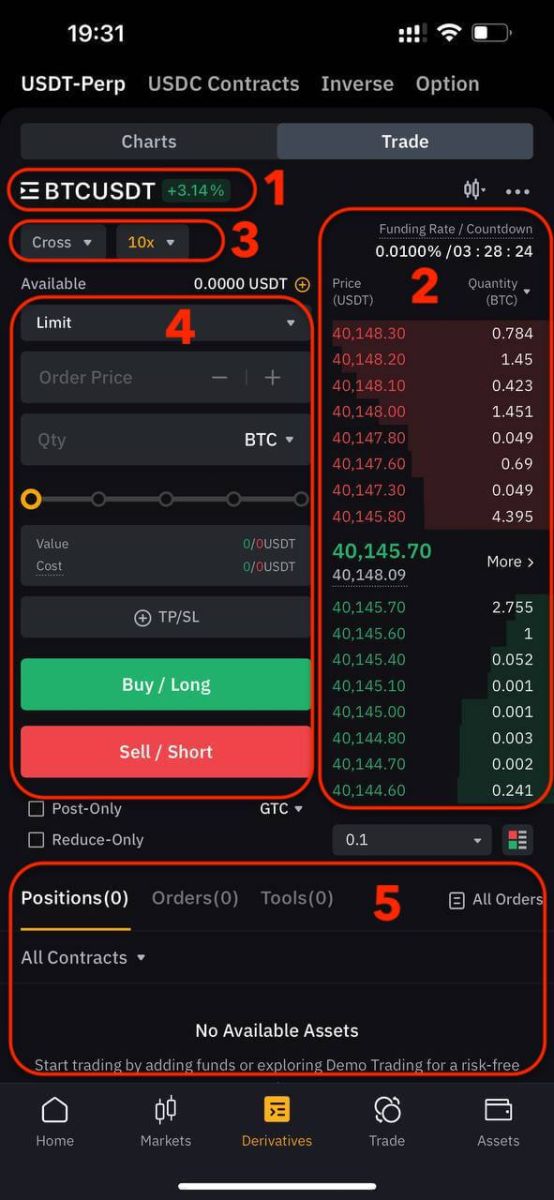

1. Sign in to your Bybit account using the mobile application and access the "Derivatives" section located at the bottom of the screen.

- Trading Pairs: Shows the current contract underlying cryptos. Users can click here to switch to other varieties.

- Orderbook and Transaction Data: Display the current order book and real-time transaction order information.

- Position and Leverage: Switching of position mode and leverage multiplier.

- Operation panel: Users can choose from a limit order, market order ...and place orders.

- Position and Order information: Current position, current orders, historical orders, and transaction history.

2. Tap on BTC/USDT situated at the top left to switch between different trading pairs. Utilize the search bar or directly select from the listed options to find the desired futures for trading.

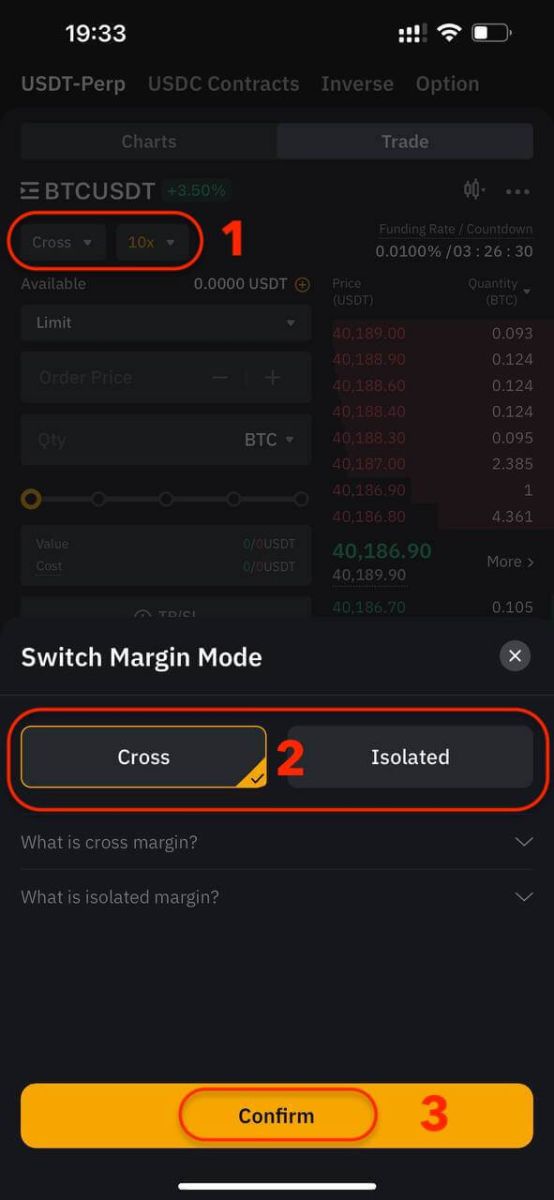

3. Choose the margin mode and adjust the leverage settings according to your preference.

4. On the right side of the screen, place your order. For a limit order, enter the price and amount; for a market order, input only the amount. Tap "Buy" to initiate a long position or "Sell" for a short position.

5. Once the order is placed, it will appear in "Current Orders."