Verify ByBit - Bybit Exchange

How to Verify an Account on Bybit

To complete your Bybit account verification, follow these straightforward steps that involve providing personal information and verifying your identity:

Web app

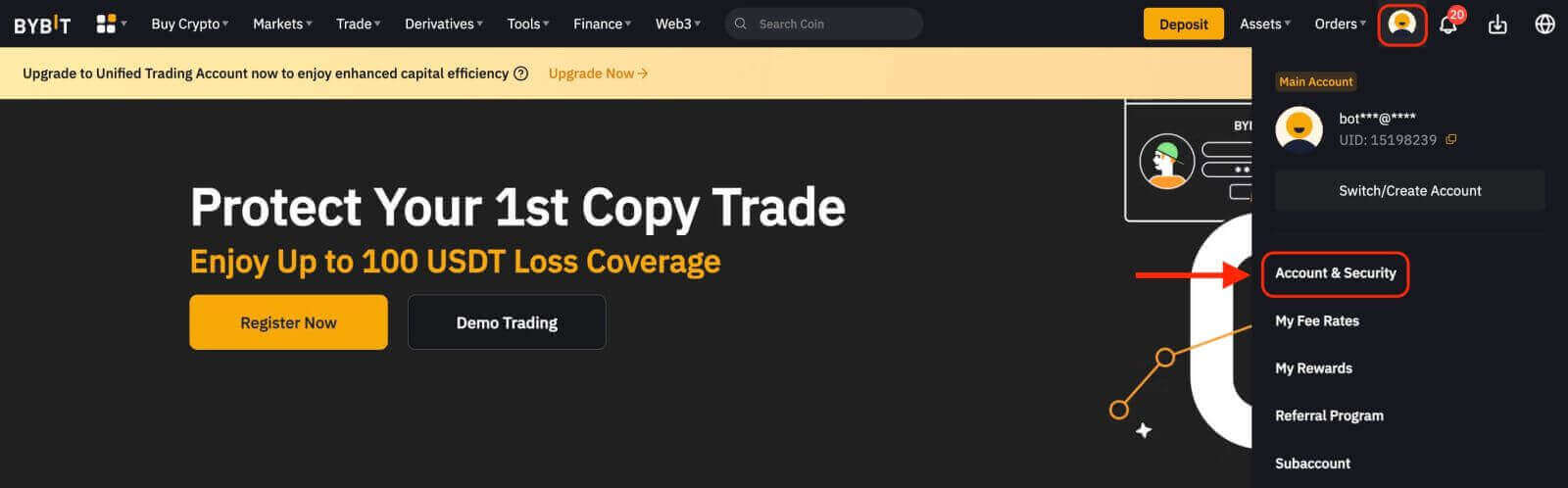

Lv.1 Identity VerificationStep 1: Start by clicking on the profile icon located in the upper right corner of the navigation bar, then select the "Account Security" page.

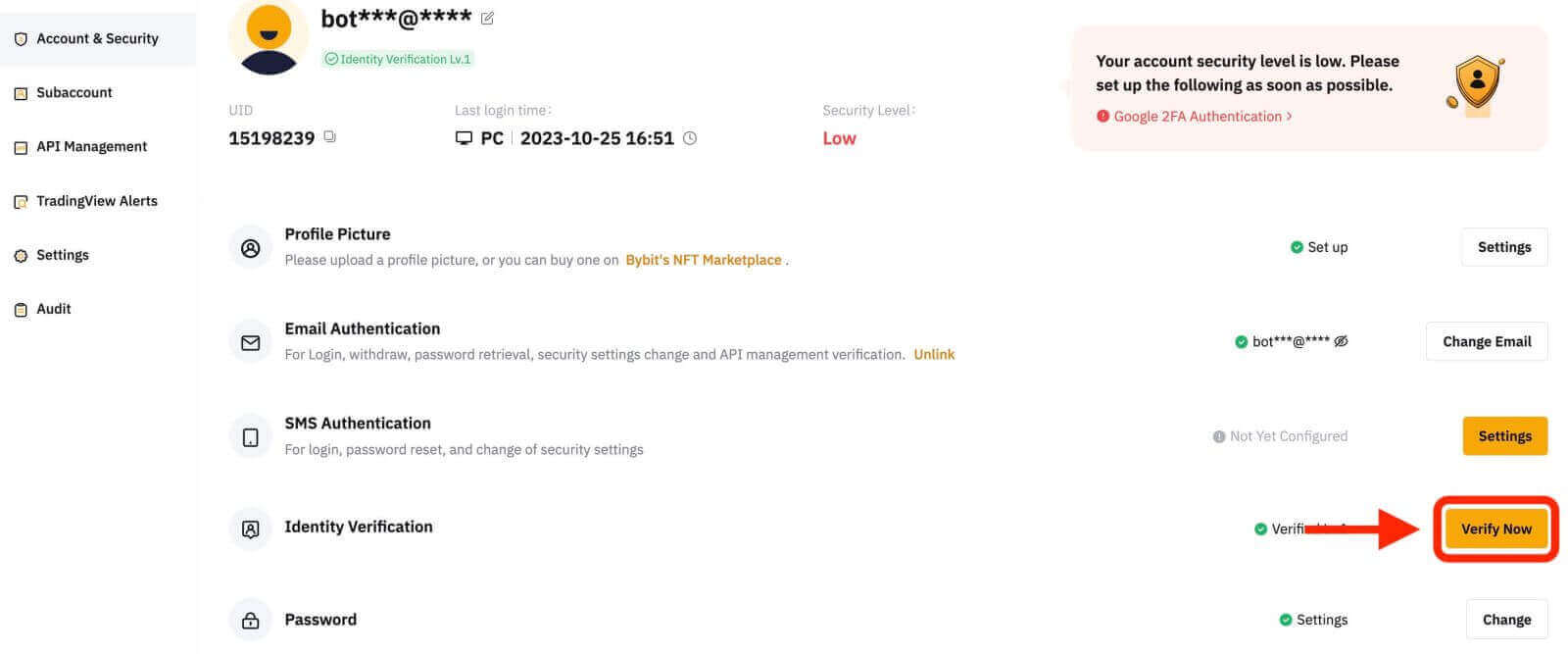

Step 2: Next, click on "Verify Now" next to the "Identity Verification" section under "Account Info" to access the Identity Verification page.

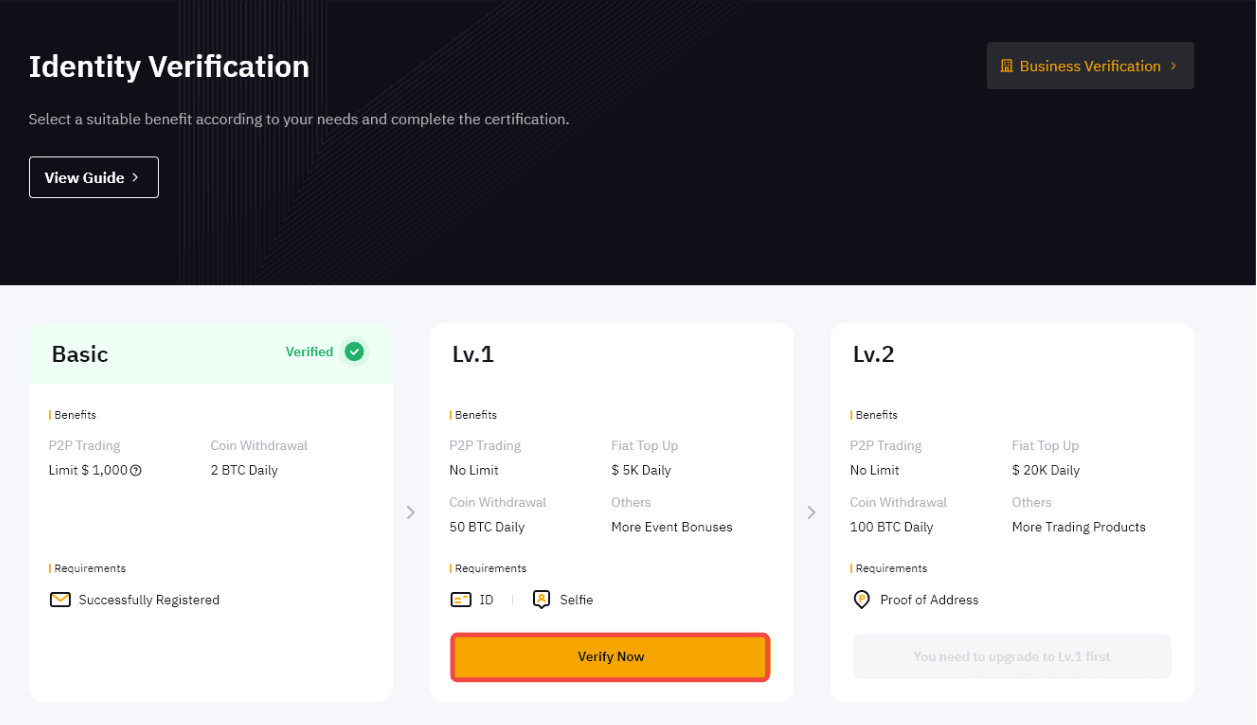

Step 3: Click on "Verify Now" under "Lv.1 Identity Verification" to begin the identity verification process.

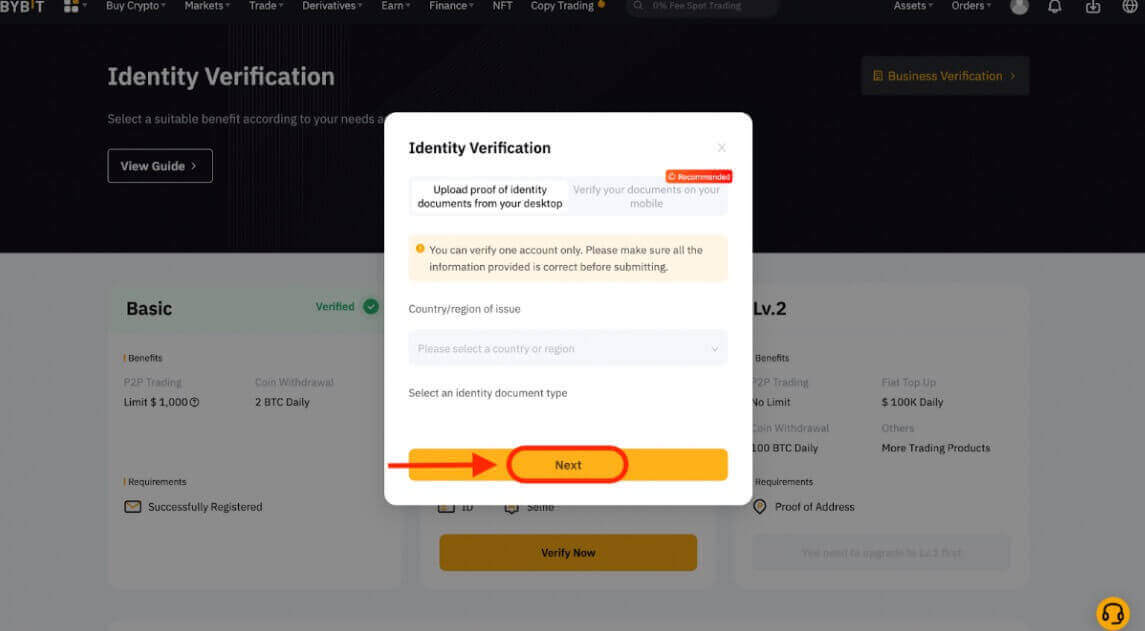

Step 4: Choose the country or region that issued your ID, and select your identity document type for uploading proof of identity document(s). Then, click "Next" to continue.

Notes:

- Ensure that the document photo clearly displays your full name and date of birth.

- If you encounter difficulties uploading photos, ensure that your ID photo and other information are clear and unaltered.

- You can upload documents in any file format.

Step 5: Complete a facial recognition scan using your laptop camera.

Note: If you encounter issues proceeding to the facial recognition page after several attempts, it might be due to non-compliance with document requirements or excessive submissions within a short time. In such cases, please try again after 30 minutes.

Step 6: To verify the information you’ve submitted, click "Next" to proceed.

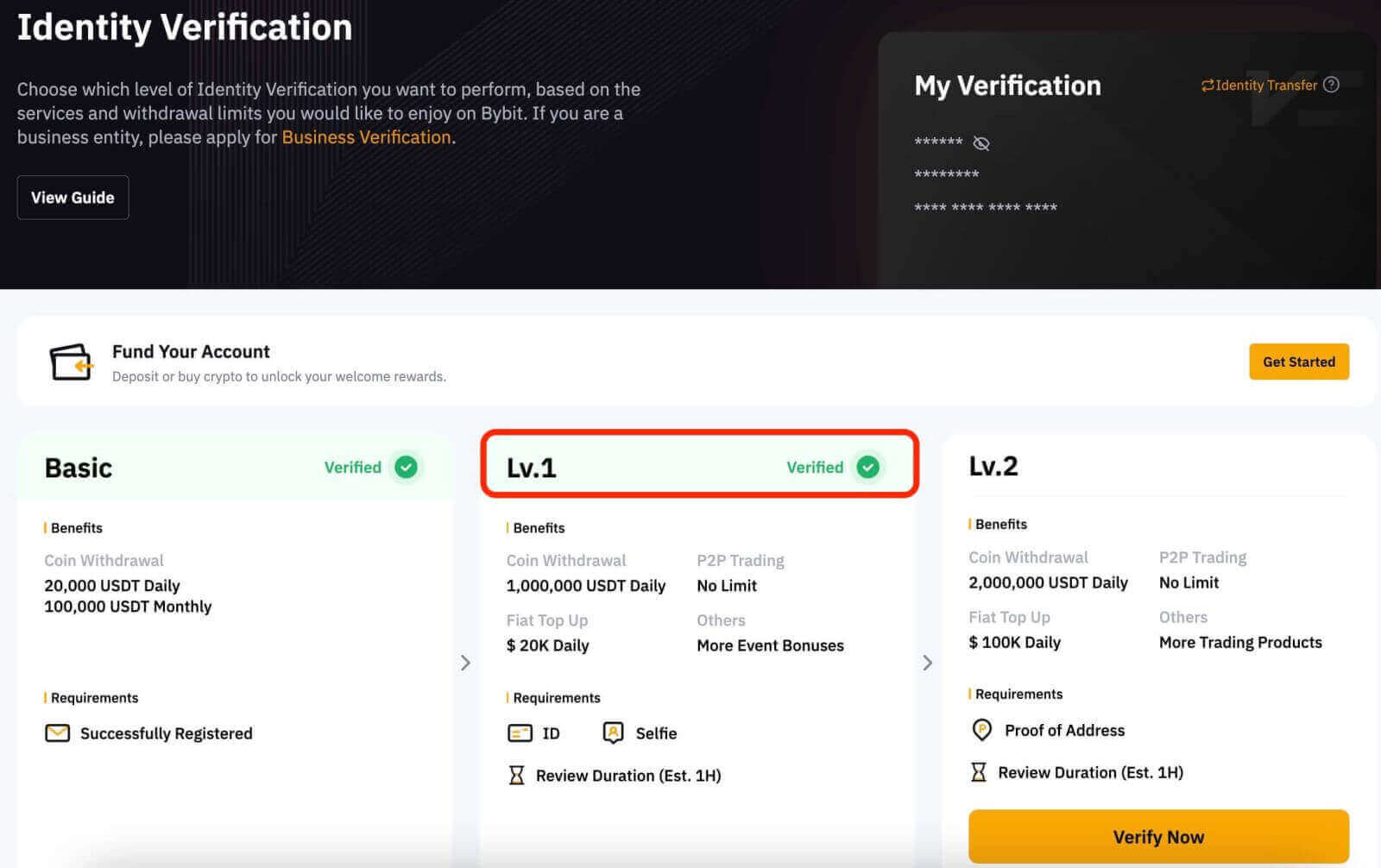

Once we have verified your information, you will see a "Verified" icon in the top right corner of the Lv.1 window, indicating that your withdrawal amount limit has been increased.

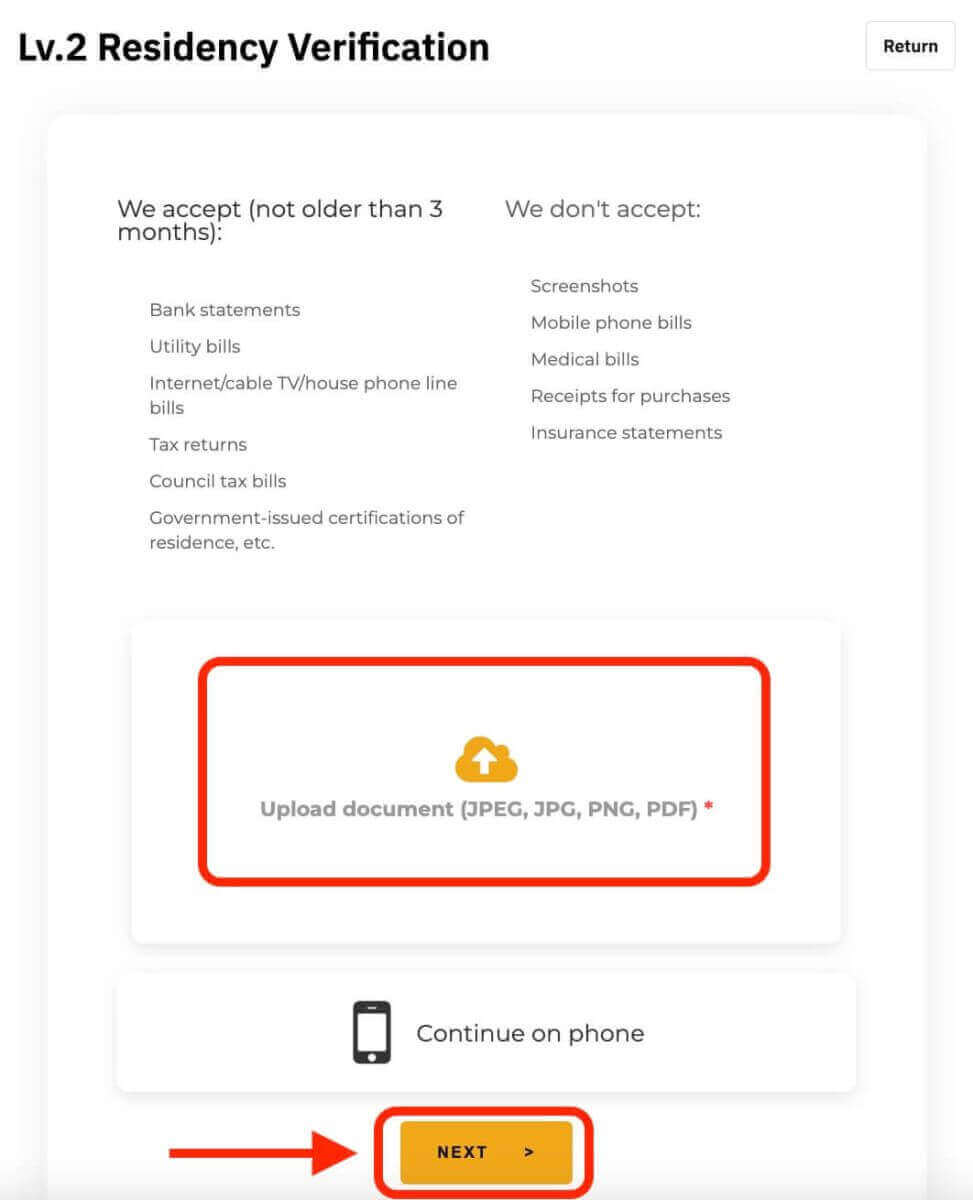

Lv.2 Identity Verification

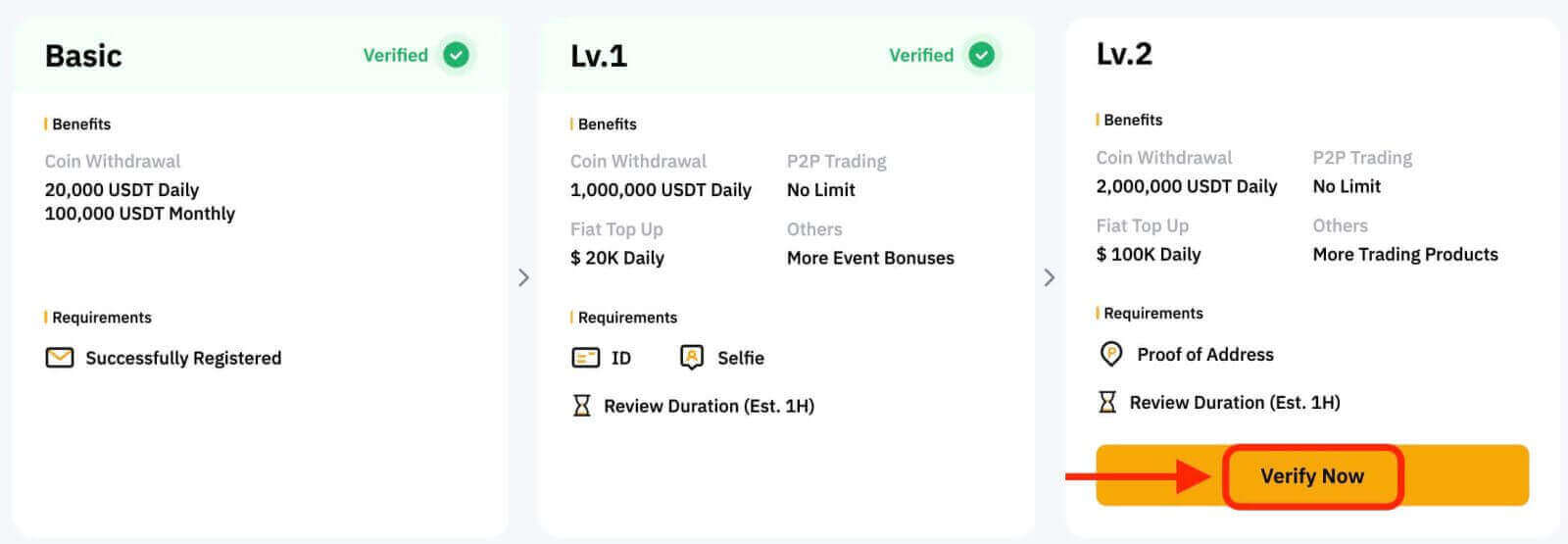

If you need higher fiat deposit and crypto withdrawal limits, proceed to Lv.2 identity verification and click "Verify Now."

Bybit accepts only Proof of Address documents, such as utility bills, bank statements, and government-issued residential proof. Ensure that your Proof of Address is dated within the last three months, as documents older than three months will be rejected.

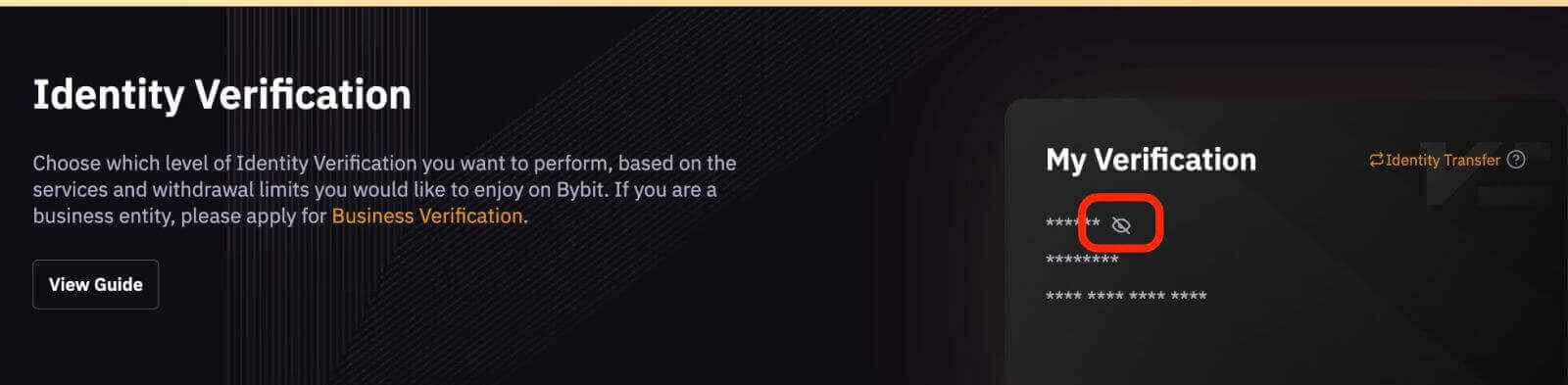

After we have successfully verified your information, your withdrawal amount limit will be increased. You can review your submitted information on the Identity Verification page by clicking the "eye" icon, but please note that you’ll need to enter your Google Authenticator code to access it. If you notice any discrepancies, kindly contact our Customer Support.

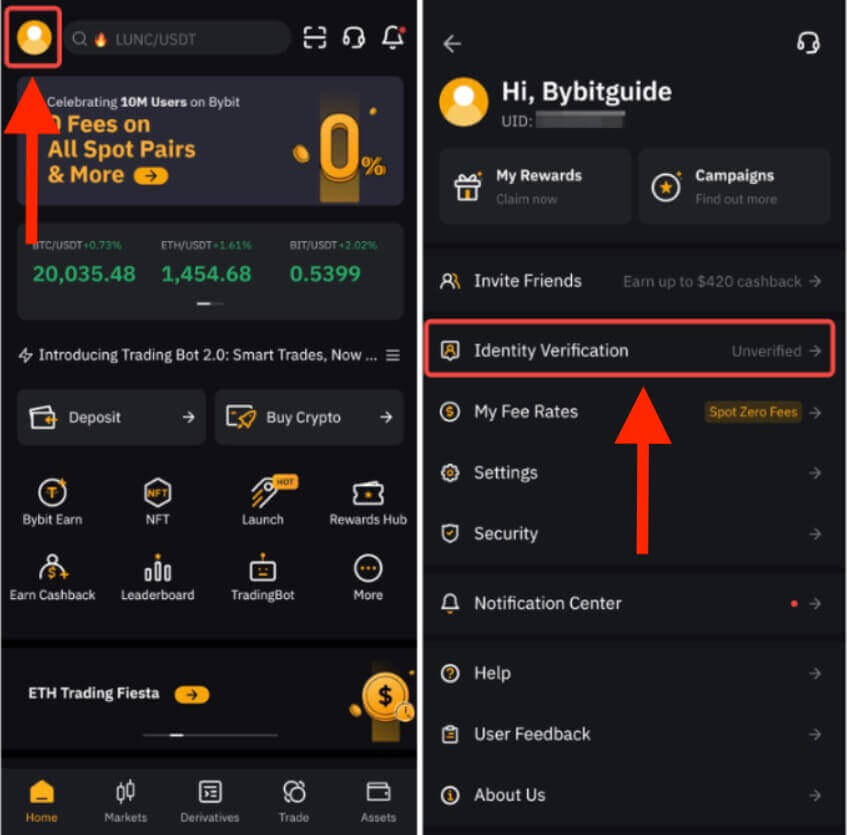

Mobile App

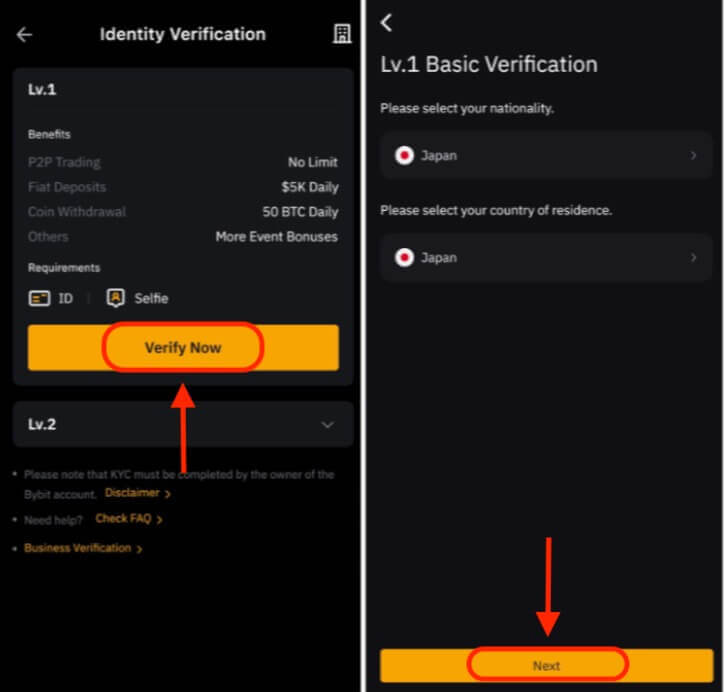

Lv.1 Identity VerificationStep 1: Begin by tapping on the profile icon in the upper left corner, then tap on "Identity Verification" to access the KYC verification page.

Step 2: Click on "Verify Now" to initiate your verification process and select your nationality and country of residence.

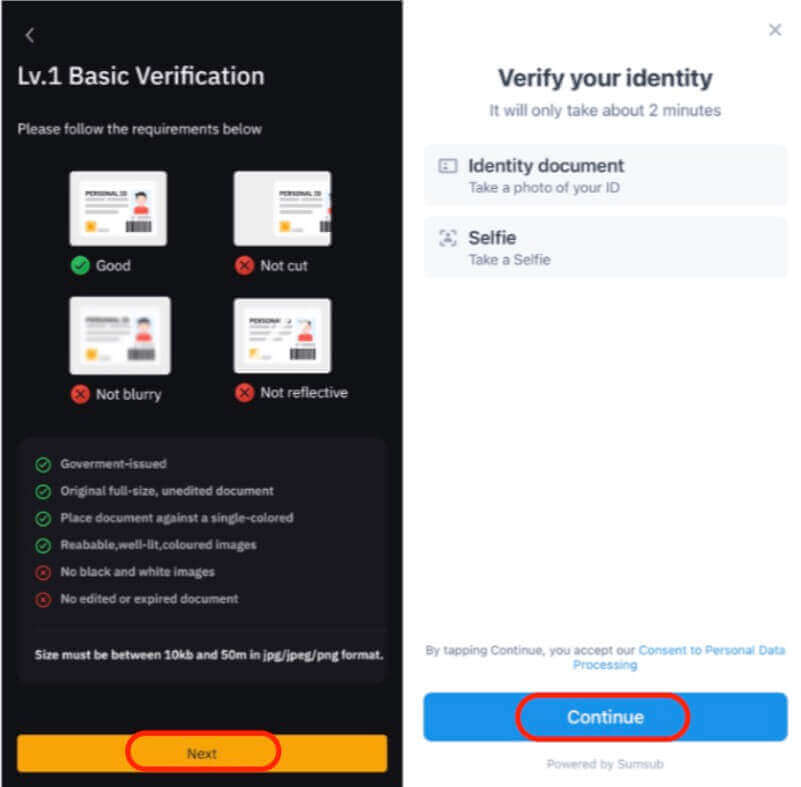

Step 3: Click "Next" to submit your identity document and selfie.

Note: If you encounter difficulties progressing to the facial recognition page after multiple attempts, it may be due to the document not meeting the requirements or too many submissions within a short time period. In such cases, please try again after 30 minutes.

Upon successful verification of your information, you will observe a "Verified" icon in the top right corner of the Lv.1 window. Your withdrawal amount limit has now been increased.

Lv.2 Identity Verification

If you need a higher fiat deposit or withdrawal limit, kindly proceed to Lv.2 identity verification and click "Verify Now."

Please be aware that Bybit exclusively accepts Proof of Address documents such as utility bills, bank statements, and residential proof issued by your government. These documents must have a date within the last three months, as any documents older than three months will be rejected.

Following the verification of your information, your withdrawal amount limit will be increased.

Special Verification Requirement on Bybit

Due to regulatory requirements in place for certain regions, please refer to the following information.

|

KYC |

Supported Countries |

Nigeria |

The Netherlands |

|

KYC Lv.1 |

|

|

|

|

KYC Lv.2 |

|

|

|

|

Bybit Card |

N/A |

|

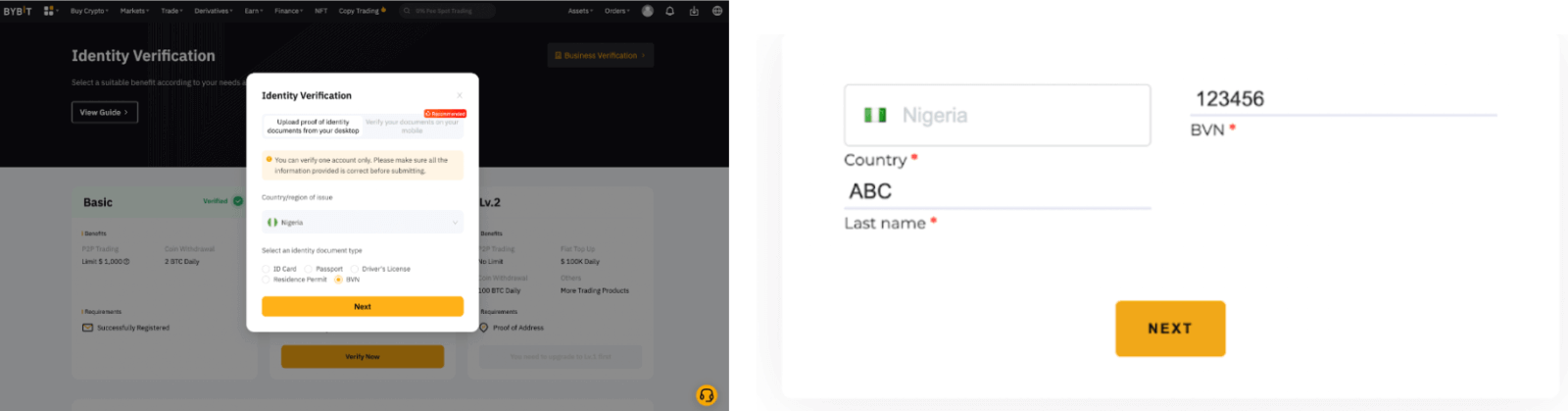

For Nigerian users

For Nigerian residents, you will need to enter your BVN number for BVN (Bank Verification Number) verification.

Tip: BVN is a unique identification number that can be verified across all financial institutions in Nigeria.

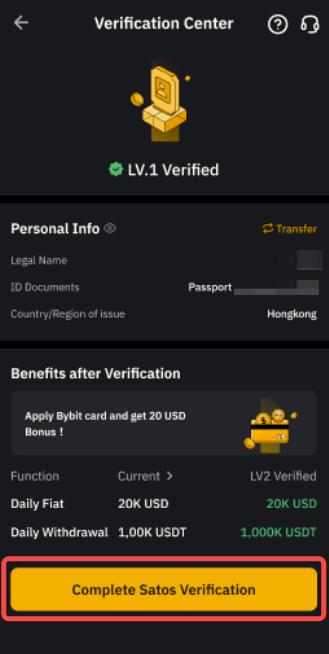

For Dutch users

Dutch residents will need to complete a set of questionnaires provided by Satos.

How long does the KYC verification process take on Bybit?

The KYC verification process typically takes around 15 minutes. However, depending on the complexity of the information being verified and the volume of verification requests, it may occasionally take up to 48 hours.The Significance of KYC Verification on Bybit

KYC verification plays a crucial role on Bybit for the following reasons:

-

Enhanced Asset Security: KYC verification serves as a robust security measure that safeguards your assets. By confirming the identity of users, Bybit ensures that only authorized individuals have access to their accounts and funds, mitigating the risk of theft or unauthorized use.

-

Diverse Trading Permissions: Bybit offers distinct levels of KYC verification, each associated with varying trading permissions and financial activities. Progressing through these verification levels allows users to access a broader array of trading options and financial services, tailoring their experience to their specific needs.

-

Increased Transaction Limits: Completing KYC verification frequently results in elevated transaction limits for both purchasing and withdrawing funds. This is advantageous for users seeking higher trading volumes and liquidity to accommodate their investment strategies.

-

Prospective Bonus Benefits: Bybit may provide bonus benefits and incentives to its users. Fulfilling the KYC requirements can render users eligible for these bonuses, enriching their trading experience and potentially boosting their investment returns.

Conclusion: Mastering Account Verification for a Secure Bybit Trading Experience

Verifying your account on Bybit is a straightforward process that enhances your trading experience and security on the platform. Whether you’re a beginner or an experienced trader, completing the verification process is a crucial step to access all the features Bybit has to offer.Remember to keep your account information secure and comply with Bybit’s terms and conditions to ensure a smooth and secure trading experience.